If an entity does not expect to recover the carrying amount of an asset the entity has incurred. Fair value is the book value of an asset that is depreciated over the useful life of the asset.

Question 51 The carrying amount of an asset is equal to the a.

. C the asset is fully depreciated. The carrying amount is equal to the cost of the asset less the accumulated depreciation. Equal to the balance of the related accumulated amortization account.

The impairment test under AASB 136 applies to all of the following assets. Transcribed image text. When a financial asset at FVPL is reclassified as FVOCI the new carrying amount is equal to Date of record It is the date on which the stock and transfer book of the corporation is closed for registration Date of declaration Dividends are recognized on the Dividend income at fair value of the property Property dividends are recorded as.

Carrying value of a fixed asset also called book value is the amount at which a fixed asset is appears on a balance sheet. The fair market value of the asset at a balance sheet date. Assets cost less residual value.

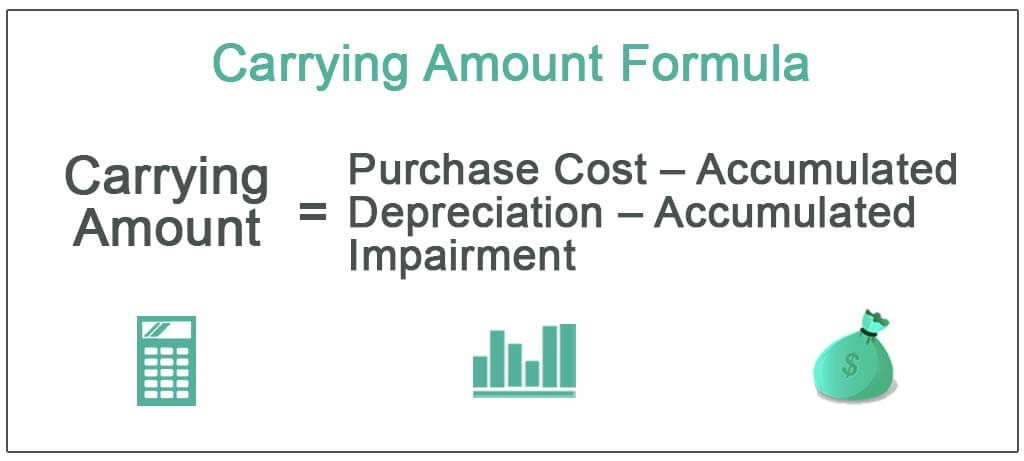

Original carrying amount c. On the other hand the recoverable amount of an asset refers to the maximum amount of cash flows Cash Flows Cash Flow is the amount of cash or cash equivalent generated consumed by a Company over a given period. It equals the original cost or revalued amount of the asset minus accumulated depreciation and accumulated impairment loss if any.

Fair value at reclassification date b. The investee earned net income of P5000000 during the current year. The carrying value of an asset means its book value.

The associated account Accumulated Depreciation has a credit balance of 43000. If the economic benefit will not be taxable the assets tax base will be equal to its carrying amount. Question 10 1 point The difference between a depreciable assetes cost and its residual value is called the.

At the time the carrying amount of the net assets of Marion Company totaled P24000 which is equal to fair value. In addition the lessor must account for the following items subsequent to the commencement date of the lease. The investee declared and paid a cash dividend of P3000000 to shareholders at year-end.

If the fair value of the underlying asset is instead equal to its carrying amount then defer the initial direct costs and include them in the measurement of the lessors investment in the lease. Present value of expected cash flows. A loss equal to the cash given up.

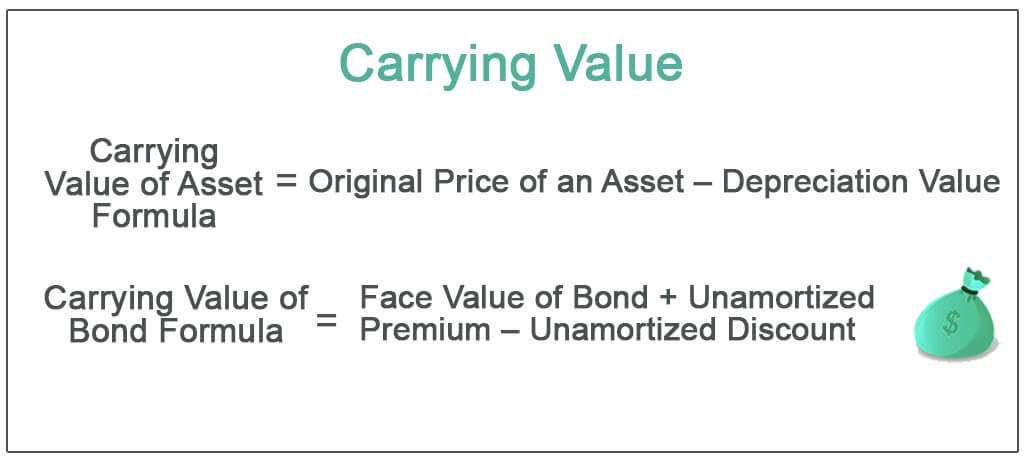

The carrying value or book value is an asset value based on the companys balance sheet which takes the cost of the asset and subtracts its depreciation over time. It is also called book value and is not necessarily the same as an assets fair value or market value. Only if there is.

Assets cost less residual value less accumulated depreciation. From the perspective of an entire business you can consider carrying value to be the net recorded amount of all assets less the net recorded amount of all liabilities. B no gain or loss on disposal is recorded.

A corporation has Bonds Payable of 3000000 and Unamortized Discount on Bonds Payable of. B No gain or loss on disposal is recorded. An assets book value is equal to its carrying value on the balance sheet and companies calculate it by netting the asset against its accumulated depreciation.

The assessed value of the asset for intangible tax purposes. Since in the exchange of plant asset Transit Co. If the carrying amount of an asset equals its selling price at the date of sale then a a gain on disposal is recorded.

It proves to be a prerequisite for analyzing the businesss strength. A liabilitys tax base is the carrying amount of the liability less any amounts that will be deductible in the future for tax purposes. Question 9 1 point The carrying amount of an asset is equal to the assets fair value less its original cost.

A loss on disposal. Present value of contractual cash flows d. An item of property plant and equipment is acquired it is recognized at its historical.

Assets fair value less its original cost. The carrying amount of an intangible is a. Chapter 09 - Multiple choice quiz.

The carrying value of an asset is the figure you record in your ledger and on your companys balance sheet. A company has a truck that has its cost of 50000 in its account entitled Truck. The trucks carry amount or book value is 7000.

Blue-book amount relied on by secondary markets. At this point there is no gain or loss. Received equipment with a fair value equal to the carrying amount of equipment given up.

The carrying amount is equal to. Transcribed image text. These factors may not reflect what the asset would sell for.

Assets cost less accumulated depreciation. The carrying amount or carrying value of the receivables is 81000. The carrying amount is the original cost adjusted for factors such as depreciation or damage.

The carrying amount is the original cost of an asset as reflected in a companys books or balance sheet minus the accumulated depreciation of the asset. When a financial asset at FVPL is reclassified to FVOCI the new carrying amount is equal. Carrying value is the original cost of an asset less the accumulated amount of any depreciation or amortization less the accumulated amount of any asset impairments.

When a fixed asset ie. D a loss on disposal is recorded. Present value of expected cash flows.

Assets cost-plus residual value less accumulated depreciation. The fair value of an asset is. The carrying amount of the bond equal to face amount is derecognized.

Assets cost less accumulated depreciation. The assets acquisition cost less the total related amortization recorded to date. Replacement cost of the asset.

Accounting And Finance Ppt Bec Doms Bagalkot Mba Finance Accounting And Finance Economics Lessons Accounting

Carrying Amount Definition Formula How To Calculate

Carrying Value Definition Formula How To Calculate Carrying Value

Capital Lease Obligation In 2021 Financial Management Learn Accounting Bookkeeping And Accounting

0 Comments